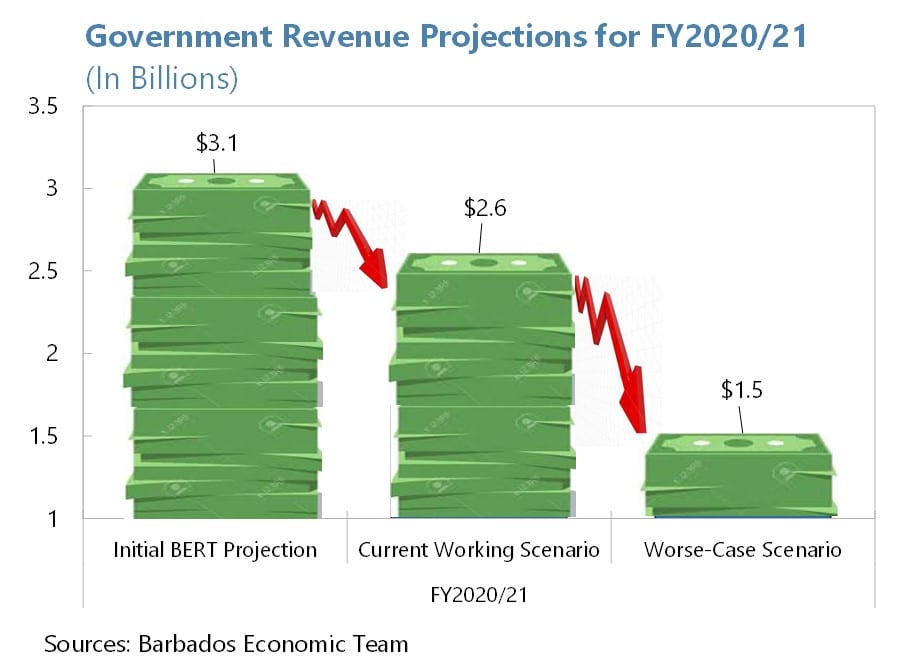

Officials of the Ministry of Finance have been meeting with representatives of the labour unions to discuss proposals to facilitate the Government’s objective of creating much needed fiscal space, given the projected decline in revenues occasioned by the global pandemic, COVID-19.

At Friday, May 27, some 41,836 claims for unemployment had been made to the National Insurance Scheme, which represents almost one-third of the workforce. Given this untenable number of persons now unemployed and projections for further declines in employment, the level of contributions to the Unemployment Fund will be significantly reduced. The government, therefore, has the fiduciary responsibility to finance shortfalls.

Discussions centred on how the Government can maintain social stability in light of an escalating unemployment situation in the private sector, which threatens to further destabilize the Government’s revenue.

The Ministry of Finance gave the assurance that, notwithstanding the challenge, Government is committed to the objective of job retention within the public service over the next 18 months except where, as previously stated, the objective of efficiency is being pursued.

The main tenet of the proposal is the opportunity to redirect funds now earmarked for public expenditure on wages and salaries to generate as much economic activity as possible within the country by shifting them to capital expenditure. This would allow the Government to finance an expansion of its capital works programme to create more jobs and complete urgent construction works without further impacting the fiscal targets and to put as many people back to work as possible, thereby easing the burden on the Government’s responsibility to finance unemployment benefits claims.

Public Service playing its part to save Barbados

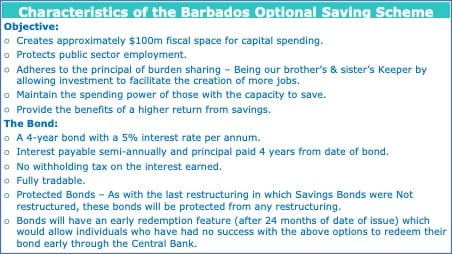

In the face of this scenario, the Ministry of Finance has recognised that the Public Service can play a key role in the stabilization efforts during this challenging time, and has devised a programme to achieve this without in any way disadvantaging these workers. The Barbados National Savings Scheme (BOSS) is like any “meeting turn” — except that you earn an attractive rate of interest on the money you save every six months and then you get back your savings after four years. It is therefore designed to provide an opportunity for public servants to optimize on the savings/investment opportunity, given the current market conditions for interest rates whilst allowing the Government to temporarily shift a portion of its wage bill to capital expenditure.

The idea is to pay workers a portion of their salary in cash (the majority) and the remainder (about 10 per cent on average) in a bond. By doing so, only the portion paid in cash is recorded as an item of expenditure on the Government’s books but not the portion paid as a bond – which is recorded as debt. So Government is now able to shift the monies that are not needed to pay the bonds now into its capital programme.

The worker still gets his/her full salary but a portion of the salary is paid in a bond, which can be easily and seamlessly converted into cash if needed, once the public officer exercises that option.

To compensate the worker for freeing up a significant amount of cash that the Government will then use to finance its critical capital works projects, which will, in turn, benefit all Barbadians through the creation of jobs and the acceleration of economic growth, the Government is offering an attractive interest rate on the bonds of five per cent.

The proposal is to convert a portion of the net take-home monthly pay of public officers according to the table shown below. It is important to note that public servants in the first band, that is, those earning less than $3,000, can exercise an option to participate if their circumstances allow, in order to benefit from the savings/investment opportunity.

| Net Monthly take-home pay including allowances | Percentage of net take-home pay converted to bonds |

| $1 – $3,000 | 0% (Persons can opt-in at a % of their choice) |

| $3,001 – $4,166 | 7% |

| $4,167 – $8,333 | 12% |

| $8,334+ | 17% |

Similarly, any public servant can choose to increase their saving options if their circumstance permit, which would allow them to maximize the savings benefits. For example, a public servant in the $3,000 to $4,000 band may choose to save 10% in Bonds as opposed to the 7% current offered, and in this regard, the Government will accommodate.

Given current interest rates in commercial banks and other financial institutions, this proposal presents a great savings opportunity for public workers. For example, if you can save just $200 a month in bonds, then over an 18-month period you would have saved $3,600 and earned interest of $720 over the four years. The public servant would only earn $21.60 if those funds were saved in a bank (some other examples are given below).

We recognized that some persons may need to have access to all their funds each month. In those instances, provision has been made for public servants to seamlessly convert bonds into cash. As long as the worker indicates, before his/her payday that he or she prefers to have the bond value in cash, this will be accommodated at par conversion (a $1 Bond converts into $1 cash). Conversions of Bonds after payday may incur a small discount as the public servant would have already benefited from some of the interest on the Bond.

It’s A WIN-WIN

This is a BOSS programme cause I’m helping my country get back on its feet. It’s not a pay-cut!! A portion is used for MY personal investment and savings.

- I get 5% interest on savings (Banks and Credit Unions only giving 0.15%)

- I’m helping my cousin and neighbour get work (There will be thousands of jobs within the capital works programme)

- I’m helping my daughter and son get a better education because the money will help with the upgrading of their schools.

- I’m helping my friend in the country because the money raised will help revamp the water systems so they can finally get water continuously.

- Plus, my car is going to last longer because they’re finally going to fix the roads. de roads too protecting the car

- And if something unforeseen happens, I can get my money whenever I want it, without waiting!!!!

Frequently Asked Questions (FAQ’s)

What is a bond?

It is a government instrument that offers a fixed rate of interest over a fixed period of time and provides a relatively safe investment for the purchaser to save money. When the government sells you a savings bond, it is in effect borrowing money from you, with a commitment to pay back this money at some predetermined date in the future and at a prescribed interest rate. The Government then uses these funds to finance public capital projects in critical areas, which will, in turn, benefit the population through the creation of jobs and the acceleration of economic growth.

What is the difference between a treasury bill and a bond?

The main difference between them is the time each one takes to mature. Treasury bills mature in a year or less, while bonds mature over a longer period. A second difference is that because of their short duration, Treasury Bills don’t make regular interest payments, bonds generally pay interest every six months.

What is the full term of the BOSS program?

A portion of your salary will be paid in a Bond each month for 18 months, and each bond will mature four years from the date it was paid to you, i.e the date it was issued.

Will I receive a lump sum of money at the end of the four (4) years? If not, how will the money be repaid?

The holder of the bond will receive interest on the Bond every six months and then the principal or value of the Bond 4 years from the date of the Bond. Note that the public servant will receive 18 Bonds over an 18-month period and each one will mature according to the date it was issued.

If the economy improves before the four years, can I draw down on my bonds?

Yes, but more importantly, you can draw down on your Bonds anytime you wish.

Why are public servants alone being asked to participate in the program?

The entire country is participating. First public servants are participating as primary savers/investors because not only is it an opportunity for the public servant to save by paying the worker a portion of his salary in Bonds, it frees up the exact amount in cash for the Government to invest in its capital program to generate jobs. Note that this is not new, as private companies sometimes offer workers shares in the company as an investment opportunity and also to grow the company. The rest of the country is also participating by standing ready to purchase any Bonds that public servants may wish to sell and thereby helping to support the development of a secondary market.

I earn less than $36,000 a year do I have to buy bonds?

No, you don’t have to buy Bonds, but of course if your finances allow for it, then it would be a wise investment choice to buy some.

Is the $36,000 calculated on your gross or net pay?

Net pay.

What if I am required to participate and cannot give up my money?

You can have your Bonds converted seamlessly by your pay date so that you end up getting all your salary in cash.

Will Government Ministers, Parliamentary Secretaries, Consultants etc. be required to purchase bonds and to what extent?

Every public sector worker is required to participate.

Can I personally sell my bonds? If so, how?

Yes, you can. You can instruct the Central Bank of Barbados to facilitate the sale of any portion of the Bonds in your Bond account and give you the cash. You can also sell your bond to any financial institution or to an individual of your choice.

If I personally sell the bonds to the public, what can I be expected to receive?

If you sell it within the same month you receive the Bond then you can expect to sell it dollar for dollar. But if you sell the Bond after some period of time then you expect to sell it at a discount, like 98 cents on the dollar.

Why not sell the bonds to the public given your assertion of their value?

Selling the Bonds to the general public will not achieve the objective of freeing up resources from the Government wage bill (which is paid in cash) for use in its capital works program.

How can I be assured that the Government will not change the terms and conditions once the program has started?

The Bonds are being provided to government employees as an equivalent value for a fixed percentage of their salary. The Constitution of Barbados protects the salaries of government employees so no matter what rates the bonds may trade at, it cannot fall below par at the time it is issued to the employee.

You may also download this document by clicking here.